Non-chargeability to tax in respect of offshore business activity 3 C. Meaning of income from forestry.

Ntn Tax Filer Pra Gst Chamber Tm Logo Reg Income Sales Tax Return E Filling Audit Notice Handling Tm Logo Tax Advisor Gulberg

This provision empowers the Comptroller of Inland Revenue to disregard vary or make such adjustments he deems appro.

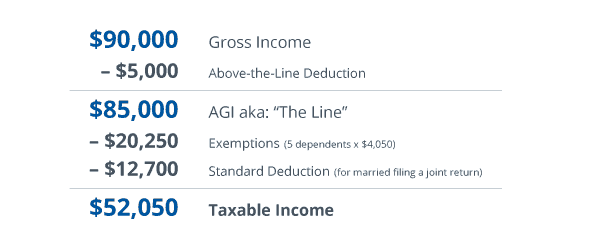

. 48 Repealed 49 Avoidance of double taxation arrangements 50 Tax credits 50A Unilateral tax credits 50B Tax credits for trust income to which beneficiary is entitled 50C Pooling of credits. A dividend and interest. 1 Subject to this Act the adjusted income of a person from a source for the basis period for a year of assessment shall be an amount ascertained by deducting from the gross income of that person from that source for that period all outgoings and expenses wholly and exclusively incurred during that.

Save as otherwise provided in this Act it shall come into force on the 1st day of April 1962. Amount of tax credit. 2 The income tax payable is calculated by applying the relevant rates of tax to the chargeable income and subtracting any allowable tax credits.

1 Subject to this Act the adjusted income of a person from a source for the basis period for a year of assessment shall be an amount ascertained by deducting from the gross income of that person from that source for that period all outgoings and expenses wholly and exclusively incurred during that. Section 331 of the Income Tax Act 1967 ITA reads as follows. Section 33 in The Income- Tax Act 1995.

Mining company or mining holding company liquidated Repealed Definitions. 58 The first limb of section 333b is concerned with the taxpayers subjective. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail.

The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. 46 Tax deducted from interests etc. Classes of income on which tax is.

1 On the death of an employee in respect of whom a tax deduction card has been issued the employer shall send to the collector of taxes the certificate relating to cessation of employment and shall insert thereon the name and address of the personal representative of the deceased employee. Interpretation PART II IMPOSITION AND GENERAL CHARACTERISTICS OF THE TAX 3. 57 The application of section 331 is limited by section 333b if the arrangement.

Section 12 of Income Tax Act. Section 11 of Income Tax Act. 47 Repealed Part 14 RELIEF AGAINST DOUBLE TAXATION.

The following income of an assessee shall be classified and computed under the head Income from other sources namely-. Meaning of main maximum deposit. 1 Subject to this Act the adjusted income of a person from a source for the basis period for a year of assessment shall be an amount ascertained by deducting from the gross income of that person from that source for that period all outgoings and expenses wholly and exclusively incurred during that period by.

Act 53 INCOME TAX ACT 1967 ARRANGEMENT OF SECTIONS PART I PRELIMINARY Section 1. 1 Subject to this Act the adjusted income of a person from a source for the basis period for a year of assessment shall be an amount ascertained by deducting from the gross income of that person from that source for that period all outgoings and expenses wholly and exclusively incurred during that period by that person in the. This is the new general anti-avoidance provision.

Section 331 of the Income Tax Act 1967 ITA reads as follows. Part 13 ALLOWANCES FOR TAX CHARGED. Is carried out for bona fide commercial reasons and had not as one of its main.

Conditions relating to market value. Income Tax Act 2007. 1 3 a In respect of a new ship or new machinery or plant other than office appliances or road transport vehicles which is owned by the assessee and is wholly used for the purposes of the business carried on by him there shall in accordance with and subject to the provisions.

1 3 a In respect of a new ship or new machinery or plant other than office appliances or road transport vehicles which is owned by the assessee and is wholly used for the purposes of the business carried on by him there shall in accordance with and subject to the provisions of this section and of section 34 be allowed a deduction in respect of the previous year in which the. In section 33 of the Income-tax Act for sub-section 3 the following sub-section shall be substituted namely 3 Where in a scheme of amalgamation the amalgamating company sells or otherwise transfers to the amalgamated company any ship machinery or plant in respect of which development rebate has been allowed to the amalgamating company under. C income from letting of machinery plants or furniture belonging to the assessee and also of buildings belonging to him if the letting of.

Net income Repealed CU 20. Section 331 of the Income Tax Act 1967 ITA reads as follows. 5 This subsection applies to an ESS interest in a company if.

B royalties and fees for technical services. Section 13 of Income Tax Act. Tax Imposed Income Tax Imposed 4.

Purposes the avoidance or reduction of tax. A in the case of an ESS interest that is a beneficial interest in a share --the discount on the ESS interest is no more than 15 of its market value when you acquire it. Short title and commencement 2.

This Act may be called the Income-tax Act 1961. Section 331 of the Income Tax Act 1967 ITA reads as follows. Charge of income tax 3 A.

It extends to the whole of India. TAX AVOIDANCE AND SECTION 33 OF THE INCOME TAX ACT This article discusses section 33 of the Income Tax Act introduced by the Income Thx Amendment Act 1988 repealing the old section. 1 Subject to this Act the adjusted income of a person from a source for the basis period for a year of assessment shall be an amount ascertained by deducting from the gross income of that person from that source for that period all outgoings and expenses wholly and exclusively incurred during that period by.

Amount treated as repayment for purposes of section CU 17. 1 Income tax is hereby imposed on every individual trustee company and non-resident who has chargeable income for the year of assessment.

Modified Scheme Of Tax Collection For Salaried Employees Cbdt Sag Infotech Tax Deducted At Source Budgeting Tax

How The Tcja Tax Law Affects Your Personal Finances

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Willing To Get Associated With A Performer

How Do State And Local Individual Income Taxes Work Tax Policy Center

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Additional Evidence Before Commissioner Of Income Tax Appeals Income Tax Income Tax

Standard Deduction Tax Exemption And Deduction Taxact Blog

Title Master Guide To Income Tax Author T G Suresh Publisher Lexisnexis 4th Edition 2017 Type Soft Cover Price Rs 1150 Income Tax Taxact Books

1099 Nec Software To Create Print And E File Irs Form 1099 Nec

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Solved C Section 33 1 Of Income Tax Act 1967 States The Chegg Com

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Share Your Tax Issues With Us Tax Services Tax Refund Tax Preparation

Income Tax Refund When There Is A Mismatch Between Actual Payable Tax And The Tax Amount Paid Then The Itr Refund Pro Tax Refund Income Tax Income Tax Return

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Blogger S Beat The Business Side Of Blogging Blogging Advice Coding Activities

Best Proprietorship Registration At Kolkata Income Tax Return Income Tax Return Filing Income Tax